The Lockdown Paradox

There is no doubt these are extraordinary and unprecedented times.

We are not community health experts so we have little to offer in terms of predicting how this pandemic is going to unfold, but it is clear capital markets are under severe stress as fear about the impact of COVID-19 spreads in advance of the virus itself.

The unfortunate reality is that in order to slow the transmission of the virus and lessen its long-term economic impact, it is necessary to take severe measures which curtail a significant level of economic activity. The only silver lining is that more aggressive and economically detrimental action now is expected to lead to much better health and economic outcomes later, a phenomenon some are now calling “The Lockdown Paradox”. In medical terms, it is as if we are putting the economy into a medically-induced coma so that we are able to come out the other side in better shape.

Obviously, no one knows what the duration of the current shutdown will be or the extent of its economic impact. What is clear is that this heightened uncertainty is largely responsible for the recent stock market declines.

While the COVID-19 pandemic is clearly a unique event, we think there are a few lessons from recent market history that are worth highlighting:

- First, market crises are unfortunately not unusual. There have been eight stock market declines of approximately 20% or more since 1990, two of which (including the recession of 2008) were decreases in excess of 50%. Each situation was unique, created panic and led to great uncertainty.

- In every crisis, there is always an extremely wide range of plausible outcomes, all of which can be hard to rationally disprove in the moment. For whatever reason, it usually seems like the loudest voices are the ones offering up the direst predictions, though they usually turn out to be incorrect. For example, in early 2009, some of the loudest voices were predicting the complete failure of our economic system and that the S&P 500 was going to decline a further 50% after it had already declined over 50%. In reality, the opposite occurred, and the market surged ahead.

- In the middle of any crisis, it always feels hopeless and as if everyone is selling. However, it is only when the dust settles that you start to hear about buyers who were thinking long term and taking advantage of opportunity. We often keep our sanity in check in difficult times like these by reminding ourselves that every day there is an equal number of shares bought and sold in the market, meaning there are always investors who think current price levels are attractive enough to be buying while others are selling. It is said that in a bear market, stocks return to their rightful owners.

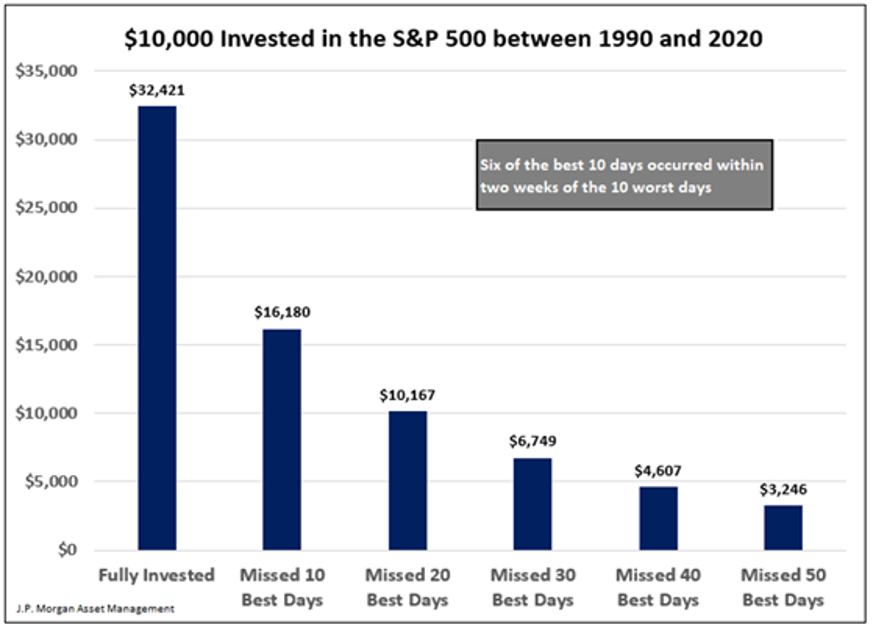

- Finally, we know there is always a huge temptation to try to time volatile markets like these as, in theory, significant losses can be avoided and/or profits earned. This is obviously easier said than done and evidence suggests that it can be disastrous to long term returns if you get it wrong. Missing only the ten best days of market returns (S&P 500) over the last 20 years would have more than halved an investor’s realized gains and it just so happens that six out of those ten best days occurred in very close proximity to the worst ten days.

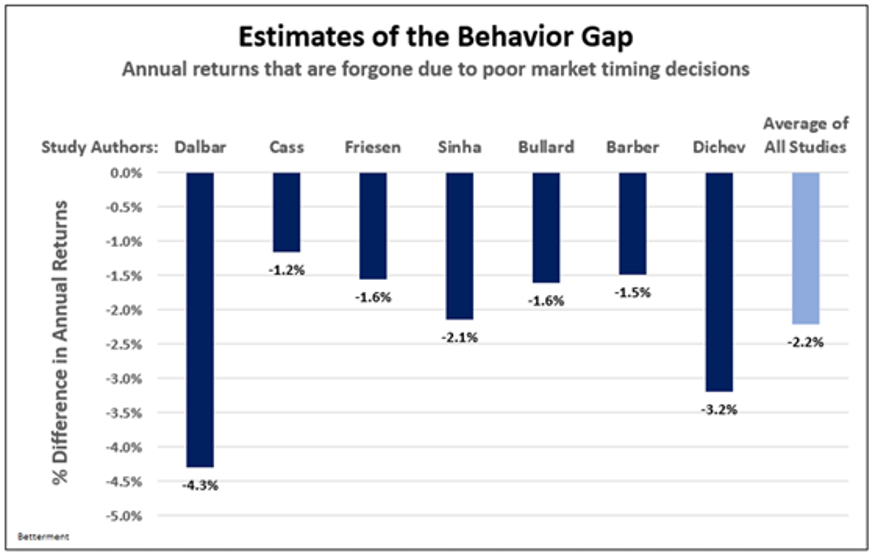

- In the same vein, there have been numerous studies that have tried to quantify the actual impact of attempted market timing by investors. This is known as the “behavioral gap” and is essentially the difference in return an investor earns from staying fully invested versus trying to move in and out of a portfolio of investments. While the different studies have calculated varying degrees of impact (from an annual loss of return from about 1% to 4%), the conclusions are the same: investors are generally bad at market timing as they tend to sell when markets are low and buy when they are high.

The one thing we do know about the current situation is that the virus is temporary and, at some point, we will move past it. We think the best indicators for the start of a sustained stock market turnaround are going to be health statistics as opposed to economic data. Investors will be watching for signs that all the restrictions placed on every-day life and social distancing practices have been successful in “flattening the curve” of cases which, as we all know by now, is the key to our health care system being able to cope with the pandemic.

When the virus eventually subsides and people and businesses emerge from this stay-at-home phase, our best guess is that both supply and demand for many goods and services will surge. Ironically, some of the companies that have been inadvertent winners from the pandemic (figuratively speaking of course) could turn out to be underperformers later in the year and companies which are most affected today, whose shares have dropped the most, could turn out to be the best performers when the market turns.

That being said, from an investment perspective, our approach has not changed. We will continue to focus on owning businesses that have a sustainable competitive advantage, earn high returns on invested capital and have an attractive runway for growth in order to compound returns. We remain disciplined in not overpaying for these attributes, as the going-in valuation is important to long term returns. Our investment team is diligently researching during this market turmoil as there will be interesting opportunities to invest in high quality businesses that are “on sale”.

As for the Bridgeport team, we are now working remotely and in daily contact with each other. As always, we are here to answer any questions you may have so please do not hesitate to reach out.

We wish you and your family all the best during these challenging times.