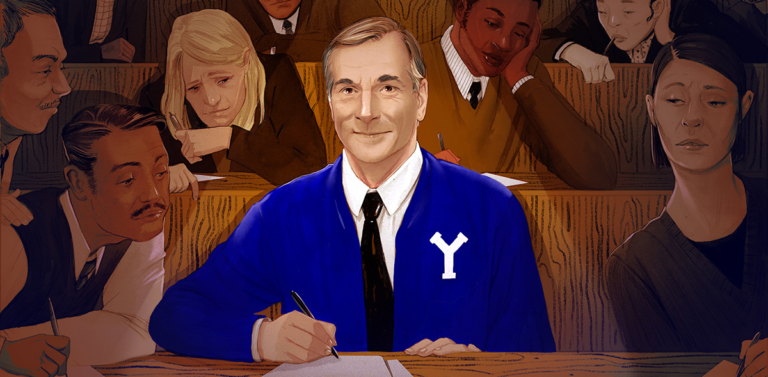

David Swensen (1954 – 2021) and The Endowment Model

Few people outside investing circles seem to have noticed the death of David Swensen this past May. Unlike Warren Buffet, Swenson was not a widely known name among the general public, despite having made a significant contribution to the world of institutional investing.

From 1985 until his recent death, Swensen had been the Chief Investment Officer for Yale University’s endowment fund, which today is valued at approximately US $31 billion. His major innovation was inventing the Endowment Model style of investing. The Model emphasizes that investment portfolios should include a wide variety of assets classes beyond traditional stocks and bonds, including private equity, venture capital, real estate, infrastructure, private lending and other non-correlated strategies.

While very common for institutional investors today, Swensen’s foray into these alternative asset classes in the 1980s was revolutionary. The prevailing wisdom then was that university endowments should stick to investing only in stocks and bonds. Swensen’s goal in diversifying Yale’s endowment into other areas was to earn more consistent, less volatile returns for the university than would otherwise be achievable by investing in traditional publicly traded assets.

Swensen’s key insight was that Yale could not only reduce the volatility of its portfolio but also enhance returns by allocating capital to asset classes that generate investment returns independent of stocks and bonds. He also believed that private markets could deliver superior returns, given they are generally less efficient than stock markets. As of June 2020, Yale’s endowment had less than 10% of its portfolio invested in U.S. stocks and had generated an unparalleled annual rate of return of 12.4% over the past thirty years.

So, if the Endowment Model makes sense for Yale and is now commonplace for other university endowments, pension funds and family offices, you may be wondering why so few individual investors follow this approach. The answer is that there have been several impediments for individuals wanting to diversify into private asset categories:

1. Not surprisingly, the most successful private asset managers generally focus their efforts on their largest institutional clients (like university endowments) who can write big investment cheques, sometimes for as much as several hundred million dollars. At the other end of the spectrum, managers often require clients to meet a minimum investment threshold of at least $2 to $5 million, an amount typically out of reach for many private investors to access these funds.

2. Unfortunately, obtaining an appropriate level of private asset investment diversification raises the bar even further for private investors. The Endowment Model involves making capital allocations to several managers within a given asset category in order to obtain an appropriate level of diversification and reduce risk. This requires investing with at least 20 to 25 managers, if not more, across several areas such as private equity, venture capital, real estate, infrastructure and private lending. Given the minimum investment requirements for each manager as discussed above, an individual investor may need at least $100 million to assemble a properly diversified private asset portfolio.

3. Because most private asset funds are structured with institutional investors in mind, they often carry terms which make it cumbersome for individuals to invest. For example, unlike a typical open-ended mutual or pooled fund, private asset funds usually require investors to commit a dollar amount that the fund manager calls in partial increments over a multi-year period. This requires the investor to make several payments over a long period of time. At the same time, investors do not typically have control over when they can redeem their investments to obtain liquidity. Rather, money is only distributed to them at the manager’s discretion when an asset is converted to cash, which also often occurs in increments spread over many years. This process of sending money and receiving it back in pieces is cumbersome for individuals to deal with, especially across multiple fund investments. In addition, the lack of control over redeeming an investment can also be problematic for private investors.

4. Most private asset funds are not registered-account eligible and, indeed, many of the best managers do not reside in Canada. This can be an issue for those private clients who may have a significant portion of their investable net worth held in a RRIF, RRSP, RESP and/or a TFSA.

5. Private asset funds can be difficult for private clients to hold in their regular investments accounts as many investment dealers simply do not want to deal with them. This can make record keeping and monitoring investment performance difficult for individuals, especially when investing across multiple funds, as investments cannot be easily consolidated in one place.

6. Finally, investing in private assets and identifying and conducting due diligence on the most successful managers requires considerable time and knowledge which often makes investing for private investors difficult.

Until recently, the above issues have made access to a diversified portfolio of institutionally managed private assets out of reach to most individual investors.

However, the good news is that Bridgeport now has several funds available (with an additional one set to launch early in 2022) which focus on private assets, allowing diversification away from stocks and bonds and a reduction in portfolio volatility.

Importantly, these Bridgeport funds solve all of the complexities mentioned in this article by providing investors well-researched, diversified portfolios of private assets in partnership with large private asset managers that are easy to invest in, can be held in your brokerage account (including registered accounts) just like your other publicly traded investments and offer periodic liquidity. We are able to access best-in-class private asset managers because we have pooled our client’s money and are able to make larger investments and meet minimum manager requirements.